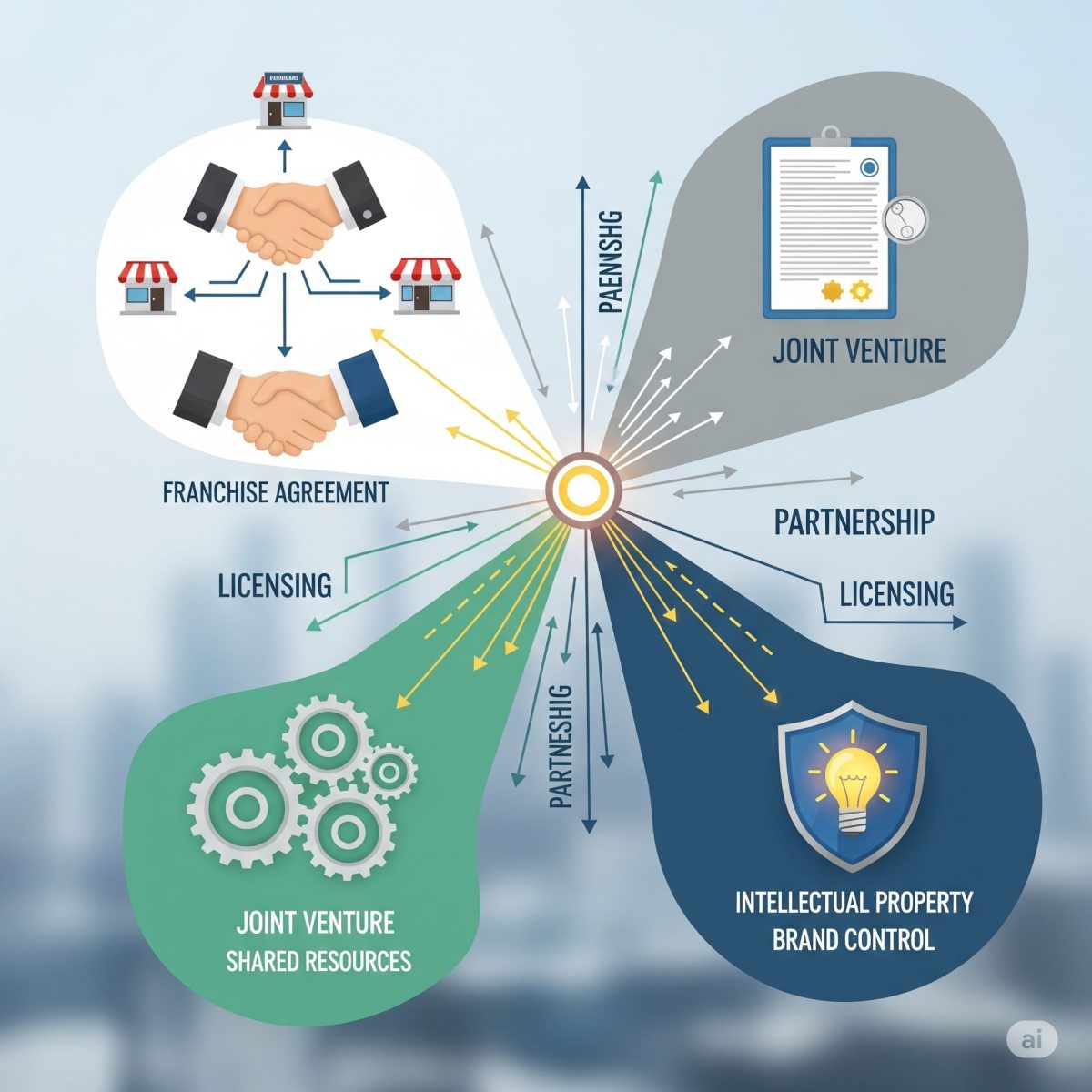

In contemporary times, companies are constantly exploring ways to expand their reach, scale operations and get access to new markets. There are many strategies for business growth. Franchising, Licensing and Joint Ventures are one of them. In this blog, we will talk about these three models in detail.

FRANCHISING

In this model, the owner of a brand grants an independent contractor the authority to run a company using the owner’s name, goods and services, system and continuing support. The franchisee agrees to abide by the franchisor’s rules and pay a fee in exchange. The franchisee uses the brand, trademarks and business processes.

The franchisor provides training, marketing support and systems. Franchisees have to pay initial setup fees and a percentage of profit. In this system standardization is crucial and all outlets must maintain consistency in quality and experience. Some of the examples of this model are Mc Donald’s, Dominos, Pizza Hut etc.

You May Read Also:

Which Franchise Model is Good For Your Business

ADVANTAGES OF FRANCHISING

- Franchisees get benefits from the reputation, credibility and proven operational systems of an existing brand.

- Franchisors provide training, marketing assistance and operational guidance. This reduces the risk of failure.

- The failure rate in this model is very low because of the tried and tested system

- Franchisees get to trusted supplier networks.

- Franchisees have better knowledge of their local markets, helping brand succeed regionally

LIMITATIONS OF FRANCHISING

- Franchisees must follow the rules, guidelines and business model set by the owner.

- There is no room for innovation and local adaptation.

- The overall profit is reduced as the franchisee has to pay royalty fees and marketing contribution.

- Negative publicity or failure of any one outlet can bring down reputation and sales of others as well

- Franchise agreements often contain strict clauses that may limit exit options and ability to switch business.

LICENSING

In this model, a Licensor grants permission to use the property as in patent, technology, design, character or brand for particular purpose to a party, in exchange of feelings or royalty. The property shared is called Intellectual Property (IP).

This system does not involve ongoing control, only the intellectual property is shared and not the business model. Licensees can operate independently. The licensee has more operational freedom. One doesn’t get comprehensive training or marketing support. Some common examples are –

- Disney licenses its characters to toy shops etc.

- Microsoft licenses Windows OS to laptop manufacturers.

You May Read Also:

Franchising Guide: Popular Industries To Consider While Trying To Invest In A Franchise Business

ADVANTAGES OF LICENSING

- Licensees get the right to use well known brands, patented technologies etc, which saves time and development cost.

- There is no need for extensive Research and Development as one can use existing innovation.

- The Licensor can continue focusing on product development while the partners handle distribution and sales.

- Licensing allows businesses to launch faster and gain instant credibility by using a well known brand or product.

- It involves having more operational freedom and very less oversight from the Licensor.

LIMITATIONS OF LICENSING

- The Licensor has limited control over how the IP is used, which can lead to misuse or poor representation.

- Delivery of low- quality product or service by licensee damages the reputation of the licensor.

- The licensee has to operate within the terms set by the Licensor.

- Constant payment of royalties or licensing fees reduces long term profitability.

- Licenses are granted for a limited period and renewal is not guaranteed.

- The licensee is restricted from developing a similar product or technology during or after the agreement.

JOINT VENTURES

A Joint Venture is an alliance made by two or more parties to work together on a particular project, business or start-up. The parties together decide to share the investment, risks, profits and control. This venture can be for a short term project or a long term work. It is usually governed by a contract. It helps combine the needed resources, expertise and market access, etc. This business model has clear agreement on profit- sharing, roles and exit terms. Examples of this model are –

- Starbucks is operated in India by Tata Group.

- Suzuki had to partner with Maruti to enter the Indian market.

You May Read Also:

How to Build a Successful Franchise Business

ADVANTAGES OF JOINT VENTURES

- Financial Burden is reduced as both parties contribute capital, technology, manpower and other resources. This also makes each partner bear less individual risks.

- Every partner brings unique skills, technologies and strengths, which leads to more efficient operations and product development.

- Local partners contribute valuable insights in customer behavior, supply chain, legal systems and government relations.

- A local partner can help a foreign company navigate legal, cultural and regulatory challenges.

- Joint ventures allow companies to quickly scale or enter new industries without building everything from scratch.

LIMITATIONS OF JOINT VENTURES

- Partners may have different business goals, management styles or strategic priorities, leading to tensions.

- One partner may contribute more capital, expertise or efforts, creating an imbalance in workload or benefits.

- Decision making is shared which slows the process and causes disputes if partners don’t agree.

- Setting up a joint venture involves complicated legal agreements, which can be time – consuming and costly.

- Poor performance of one partner can damage the overall image and success of the joint venture.

You May Read Also:

Startup Freedom or Franchise Security – What’s the Right Path for You?

COMPARISON

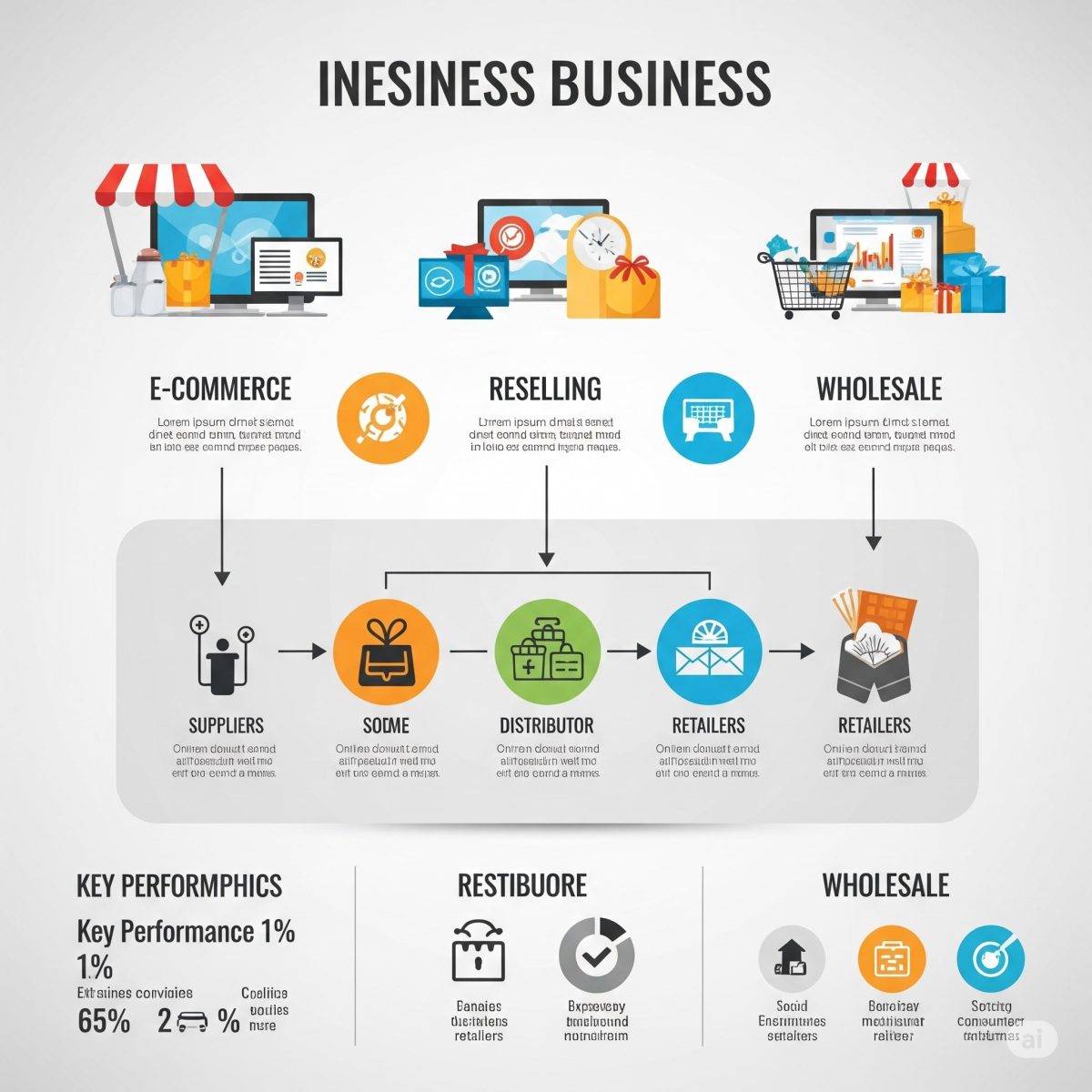

Franchising, Licensing, and Joint Ventures are three different models of business collaboration, each with distinct characteristics. Franchising focuses on both the brand and the business model. The relationship is contractual and ongoing, where the franchisor retains significant control over operations, brand use, and quality standards. The investment is typically made by the franchisee, who receives support in operations, training, and marketing. This arrangement is generally long-term, with the franchisee bearing most of the business risk.

A common example of franchising is a Subway outlet. Licensing, on the other hand, is centered around intellectual property (IP). The legal relationship is contractual but more limited in scope and duration. The licensor has little to no control over how the IP is used after licensing. Investment is minimal or none from the licensee’s side, and no operational support is provided. The duration of a licensing agreement can vary, often being short or for a fixed term. The licensee assumes most of the risk.

A typical example is Marvel licensing Spider-Man to a toy manufacturing firm. Joint Ventures (JVs) involve a shared business operation or project where both parties come together, usually forming a new legal entity or entering a partnership agreement. Control and investment are shared, and the level of support and operational involvement depends on the agreement. JVs are generally project-based or fixed-term in nature, with risks also being shared. A notable example is the Tata–Starbucks joint venture.

Franchising, licensing, and joint ventures each offer unique pathways for business expansion, but they come with distinct structures, levels of control, and risk-sharing dynamics. Franchising suits those looking for a replicable business model with strong brand control. Licensing is ideal for companies aiming to monetize intellectual property with minimal operational involvement.

Joint ventures offer a collaborative approach, pooling resources and expertise for mutual benefit especially in new markets. The right choice depends on your business goals, available resources, risk appetite, and the level of control you wish to maintain. By carefully evaluating these models, entrepreneurs and companies can select a strategy that not only fits their vision but also ensures sustainable and strategic growth.

This graph clearly shows how OYO Rooms grew rapidly from 2015 to 2024. From just 1,000 hotels in 2015, OYO expanded to over 100,000 hotels worldwide by 2024. It’s a strong example of what consistent vision and hard work can achieve.

This graph clearly shows how OYO Rooms grew rapidly from 2015 to 2024. From just 1,000 hotels in 2015, OYO expanded to over 100,000 hotels worldwide by 2024. It’s a strong example of what consistent vision and hard work can achieve.