The growing technology has made the current time a digital era. The access to the internet has made online shopping a common and more preferred activity. Everyone wants to shop from home; saving time and energy. To adapt to the new lifestyle, businesses need to go online. WhatsApp which was earlier used for chatting is now a powerful tool. WhatsApp Business allows you to carry your business in your pocket. It has features like WhatsApp Catalog which can help you sell products to the customers.

WHAT IS WHATSAPP CATALOG ?

WhatsApp catalog is like a digital shop, which you can make using WhatsApp business app. It allows you to add pictures, prices and other details about your product. For example- if you are planning to sell handmade Rakhis, you can use the feature and add the pictures, names, prices and other details about it. You can then share the product links with your customers.

You May Also Read:

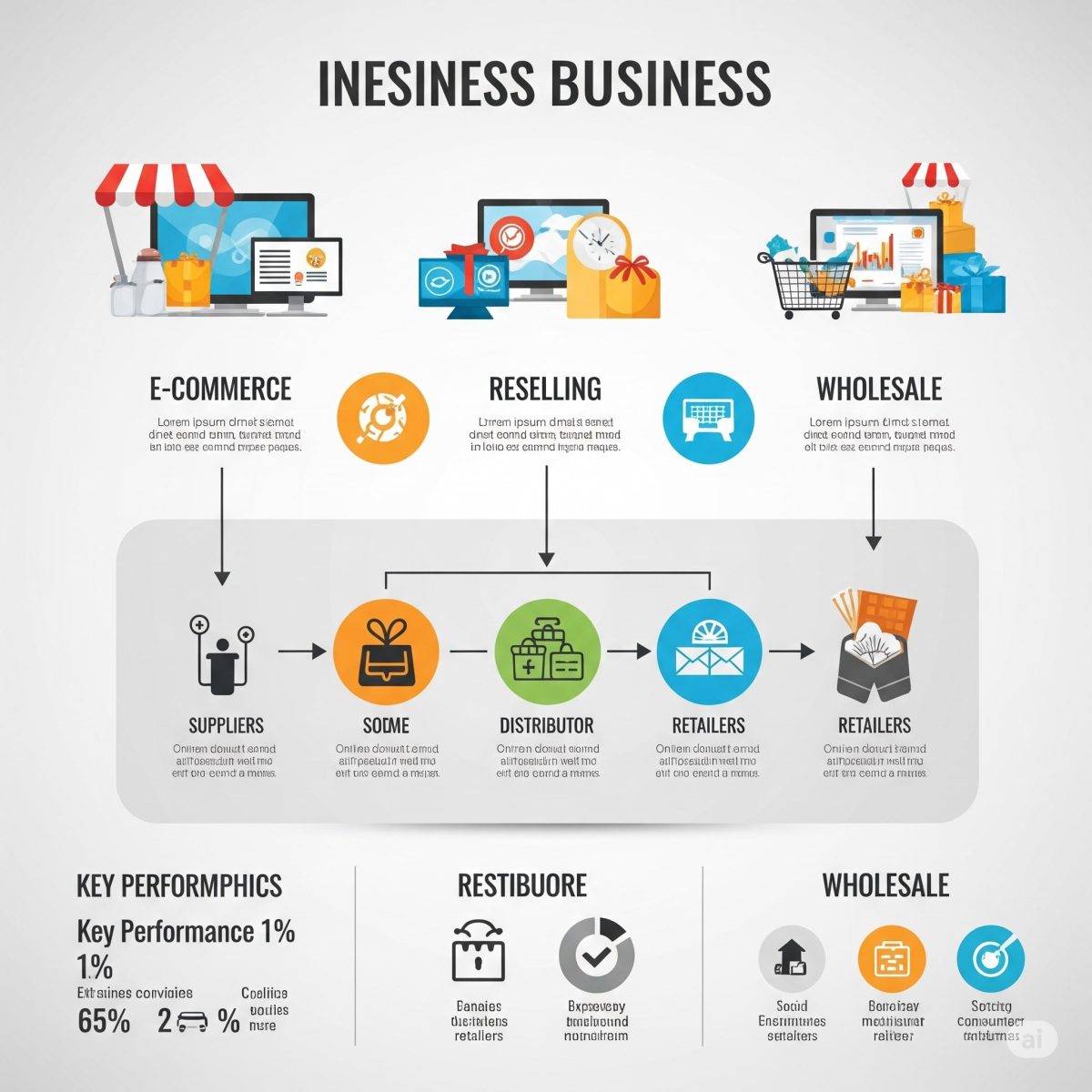

E-Commerce vs Reselling vs Wholesale – Which One is Right for You?

HOW TO MAKE WHATSAPP CATALOG ?

For making WhatsApp Catalog, you need to download the WhatsApp Business App available on play store and app store. After downloading, one has to login using their business number and set up the profile. While setting up the profile, you have to add business name, photo, category, address and website if available.

In order to make a catalog, click on “More Options” and select “Business Tools”. Tap on “catalog “and click on ‘Add New Item’. Therein add the information like product name, category, prices, photos, link or product code and other details. Save this information and your product is now registered on WhatsApp catalog.

You may also read:

How to Increase Sales with Low-Cost Marketing Ideas

HOW TO SELL PRODUCTS USING WHATSAPP CATALOG ?

After saving your product, the next step is to sell it. You can sell your product by sending its link or code to customers through chat, in this way the customer can easily get all the information about the product. Ask your customer to send these to their friends as well. Set up auto-send messages or quick replies so that the customer can easily order the product. Set up a team to reply to people and track the orders.

Use other features of WhatsApp like status and broadcast for promotions. Put your product on status everyday. Upload its photos, videos etc daily. Make a broadcast list and add customers on it. Take consent before adding the customer and then send them daily updates etc. Use groups to keep customers as a community. Add your loyal customers in the group and send them details about new products etc.

You May Also Read:

Zero Dollar Marketing Strategies to Attain More Customers

TIPS TO USE WHATSAPP CATALOG EFFICIENTLY

- Customers want to see the product clearly before buying and therefore you should always upload clear and attractive photographs.

- Customers like to ask very specific questions about the products and need clear answers. If their questions would be answered in the description, they would not be hesitant to buy the product. And hence you should always write short and simple descriptions.

- We as business persons always look out for profit and similarly customers also like to do so. To entice your customers, you should give them discounts and rewards. Ping them about offers and discounts.

- Customers have a low patience level and will go to other business profiles to buy the product if they aren’t answered on time therefore try to reply quickly so that the customer gets impressed.

As the head of business, one needs to do a lot of things. Replying to customers becomes difficult while working and hence you should set ‘auto-reply’ messages.

You May Also Read:

Reasons To Hire A Marketing Agency That Will Help Your Business Reach Its True Potential

BENEFITS OF USING WHATSAPP BUSINESS

- WhatsApp Business is a free and easy to use app. One doesn’t need to have grave technological knowledge for using it. Anyone with a smartphone can use it and get the benefits.

- The feature of the catalog helps you give a smart presentation of the product. Customers get details about the product in just one click, which is time-saving for them.

- This app also helps in instant marketing as everybody has a smartphone and would check statuses and messages. You can post your product link on status and various groups and chats.

- WhatsApp is predominantly a chatting app, and thus this enables the customers to have direct conversation and clear their doubts.

- This allows people to see the product clearly, get detailed information in one click and have instant replies to queries, which makes chances of returns very low.

CONCLUSION

WhatsApp Business is a great push for small businesses. It is a free tool which helps in branding, marketing, chatting and above all selling your product. This neither requires some technical knowledge nor any investment. This is a daily use app which can help you sell your products professionally. This only requires a smartphone and time, and you are good to go.

If you’re also struggling with low sales in your business, this article can be extremely helpful for you. Moreover, if you’re facing any kind of challenge in your business and are looking for expert guidance, click on the link to the Leadership Funnel Program and get in touch with us now.

If you’re also struggling with low sales in your business, this article can be extremely helpful for you. Moreover, if you’re facing any kind of challenge in your business and are looking for expert guidance, click on the link to the Leadership Funnel Program and get in touch with us now.